How to Finance Your Roof Replacement Project

Explore various financing options for your roof replacement, including loans, insurance, and payment plans.

Explore various financing options for your roof replacement, including loans, insurance, and payment plans. Replacing your roof is a significant investment, often one of the largest home improvement projects you'll undertake. It's not just about aesthetics; a new roof protects your home, enhances energy efficiency, and can even boost its resale value. But let's be real, the cost can be daunting. Don't let that deter you! There are numerous ways to finance your roof replacement, making it an achievable goal for almost any homeowner. This guide will walk you through the most common and effective financing strategies, helping you find the best fit for your budget and situation.

How to Finance Your Roof Replacement Project

Understanding Your Roof Replacement Costs and Budgeting for Your New Roof

Before diving into financing options, it's crucial to have a clear understanding of what your roof replacement will actually cost. This isn't a one-size-fits-all number. Factors like the size of your roof, the materials you choose (asphalt shingles, metal, tile, etc.), the complexity of the roofline, labor costs in your area, and any necessary structural repairs will all play a role. Get at least three detailed quotes from reputable roofing contractors. These quotes should break down material costs, labor, permit fees, and debris removal. Once you have a realistic estimate, you can start budgeting. Consider setting aside a portion of your savings, if possible, to reduce the amount you'll need to finance. A good rule of thumb is to aim for a 10-20% down payment if you're taking out a loan. This shows lenders you're serious and can sometimes lead to better interest rates.Home Equity Loans and Lines of Credit HELOC for Roof Financing

One of the most popular ways to finance a major home improvement like a roof replacement is through your home equity. Home equity is the difference between your home's market value and what you still owe on your mortgage. As you pay down your mortgage and your home's value appreciates, your equity grows. There are two main ways to tap into this: a Home Equity Loan (HEL) and a Home Equity Line of Credit (HELOC).Home Equity Loan Explained for Roofing Projects

A Home Equity Loan is a second mortgage that provides you with a lump sum of cash. You'll receive the full amount upfront and then repay it over a fixed period, typically 5 to 20 years, with a fixed interest rate. This predictability makes budgeting easier. It's a great option if you know the exact cost of your roof replacement and want consistent monthly payments. The interest on a home equity loan may also be tax-deductible if the funds are used to substantially improve your home, which a new roof certainly does. Always consult with a tax professional for personalized advice.Home Equity Line of Credit HELOC for Flexible Roof Funding

A HELOC, on the other hand, works more like a credit card. You're approved for a maximum borrowing amount, and you can draw funds as needed over a set 'draw period,' usually 5 to 10 years. During this period, you typically only pay interest on the amount you've borrowed. Once the draw period ends, you enter the 'repayment period,' where you pay back both principal and interest, usually over 10 to 20 years. HELOCs often have variable interest rates, which means your payments can fluctuate. This option offers more flexibility if your project costs might change or if you want to spread out your expenses. For example, if you're unsure about potential hidden damage that might increase the cost, a HELOC allows you to access more funds if needed without reapplying.Personal Loans for Roof Replacement Fast and Unsecured Options

If you don't have sufficient home equity or prefer not to use your home as collateral, a personal loan can be a viable option. Personal loans are typically unsecured, meaning they don't require collateral like your home. This can be a big advantage if you're uncomfortable putting your home at risk. However, because they're unsecured, interest rates can be higher than home equity products, especially if your credit score isn't stellar.Key Features of Personal Loans for Roofing

Personal loans offer a lump sum of money that you repay over a fixed term, usually 1 to 7 years, with fixed monthly payments. The application process is often quicker than for home equity loans, and funds can be disbursed within a few business days. Your eligibility and interest rate will largely depend on your credit score, income, and debt-to-income ratio. Many banks, credit unions, and online lenders offer personal loans. It's always a good idea to shop around and compare offers from multiple lenders to find the best rates and terms.Recommended Personal Loan Providers for Home Improvements

While I can't endorse specific financial products, here are some types of lenders and platforms known for personal loans that homeowners often consider for projects like roof replacement:- Traditional Banks: Major banks like Chase, Wells Fargo, Bank of America, and Citibank offer personal loans. They often have competitive rates for existing customers and a familiar application process.

- Credit Unions: Local credit unions often provide more personalized service and can sometimes offer lower interest rates than big banks, especially for members.

- Online Lenders: Platforms like LightStream (known for competitive rates for excellent credit), SoFi (offers loans with no fees and unemployment protection), Marcus by Goldman Sachs (no fees, fixed rates), and LendingClub (peer-to-peer lending) are popular. These often have streamlined online application processes and quick funding.

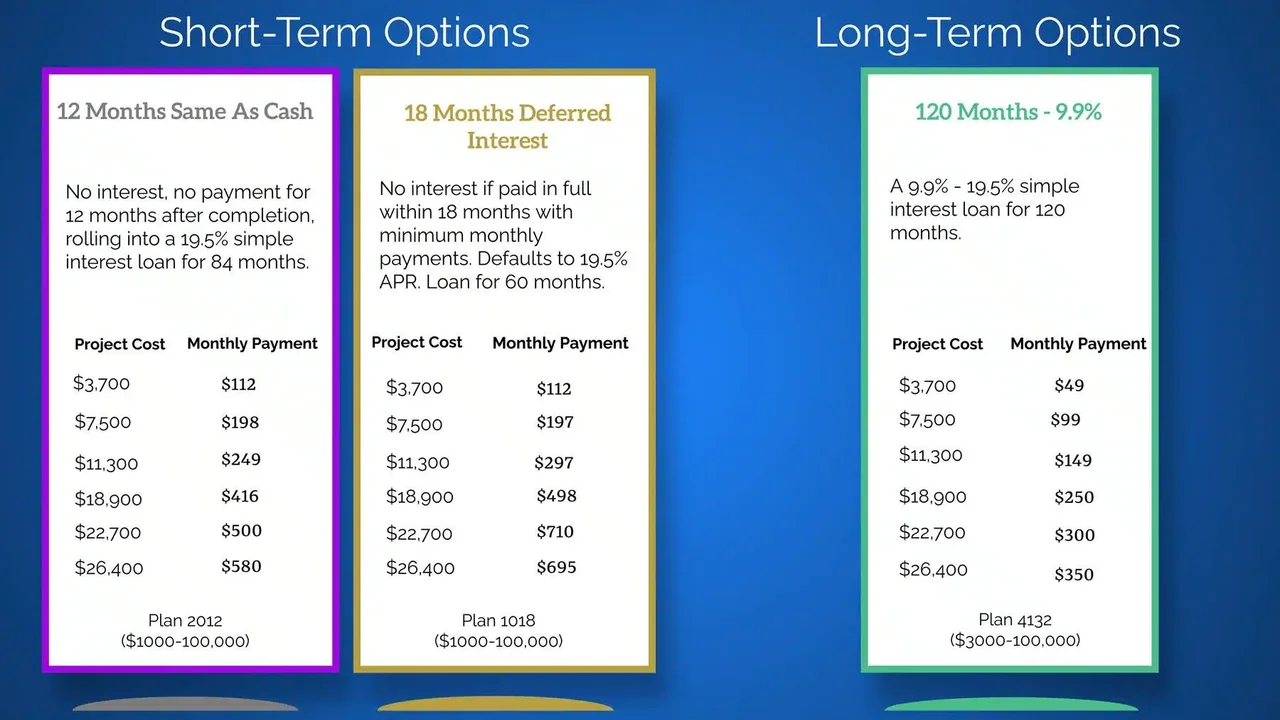

Contractor Financing and Payment Plans for Your New Roof

Many roofing contractors understand that financing is a major concern for homeowners and offer their own financing solutions or partner with third-party lenders. This can be a convenient option, as you can often apply for financing directly through your contractor.Benefits of Contractor Financing for Roofing

Contractor financing can simplify the process, as the contractor often handles the paperwork and coordination with the lender. They might offer special promotions, such as 0% interest for a certain period (e.g., 6 or 12 months), which can be a fantastic way to save money if you can pay off the loan within that promotional window. However, be very careful with deferred interest plans; if you don't pay off the full balance by the end of the promotional period, you could be charged interest retroactively from the original purchase date.Questions to Ask About Contractor Payment Plans

Always ask your contractor about the terms and conditions of their financing options. What's the interest rate after the promotional period? Are there any hidden fees? What's the loan term? Is it an unsecured loan or does it place a lien on your home? Compare their offer with other financing options you've explored to ensure you're getting a competitive deal. Sometimes, contractor financing can be more expensive than a personal loan or HELOC, so do your homework.Government Programs and Grants for Roof Repair and Replacement

Depending on your location and income, you might qualify for government assistance programs or grants designed to help homeowners with essential home repairs, including roofing. These programs are often aimed at low-income individuals, seniors, or those living in designated revitalization areas.Federal and State Assistance for Roofing Costs

In the United States, programs like the Department of Housing and Urban Development (HUD) offers various grants and loan programs through state and local agencies. The USDA Rural Development program provides loans and grants to low-income homeowners in rural areas for home repairs. Many states also have their own housing finance agencies that offer assistance. For example, some states might have programs for energy-efficient home improvements, which a new, insulated roof could qualify for.How to Find Local Roofing Assistance Programs

Start by contacting your local housing authority or community development office. They can provide information on programs available in your specific area. Websites like USA.gov or Benefits.gov can also be good starting points for searching federal and state assistance. Eligibility requirements vary widely, so be prepared to provide documentation of your income, household size, and property ownership.Insurance Claims for Storm Damaged Roofs

If your roof replacement is due to damage from a storm, fire, or other covered peril, your homeowner's insurance policy might cover a significant portion, if not all, of the cost. This is often the most cost-effective way to finance a new roof, as you'll only be responsible for your deductible.Navigating the Roof Insurance Claim Process

Immediately after discovering damage, document everything with photos and videos. Contact your insurance company as soon as possible to file a claim. They will send an adjuster to assess the damage. It's often beneficial to have your roofing contractor present during the adjuster's visit, as they can point out damage that might be missed and advocate on your behalf. Be prepared to provide your contractor's estimate to the insurance company. The process can sometimes be lengthy, so patience is key. Understand your policy's coverage limits, depreciation clauses, and deductible amount.Tips for a Successful Insurance Claim

- Document Everything: Photos, videos, dates of damage, communication with your insurer.

- Understand Your Policy: Know your deductible, coverage for different types of damage (e.g., wind vs. hail), and whether your policy covers replacement cost value (RCV) or actual cash value (ACV). RCV pays for a new roof, while ACV deducts for depreciation.

- Get Multiple Estimates: While your insurer might have preferred contractors, you have the right to choose your own.

- Be Persistent: If you feel your claim is being undervalued, don't hesitate to appeal or seek professional help from a public adjuster.

Credit Cards for Smaller Roof Repairs or Down Payments

While generally not recommended for a full roof replacement due to high interest rates, credit cards can be useful for smaller, emergency repairs or to cover a down payment. If you have a credit card with a 0% introductory APR offer, this could be a short-term solution, but only if you are absolutely confident you can pay off the balance before the promotional period ends. Otherwise, the deferred interest can quickly make the repair much more expensive.Using Credit Cards Wisely for Roofing Expenses

If you do use a credit card, treat it as a short-term bridge loan. Have a clear plan for repayment. For example, if you're waiting for an insurance payout or a personal loan to come through, a credit card can cover immediate costs. However, for a full roof replacement costing tens of thousands of dollars, the interest charges on a standard credit card will quickly become unmanageable.Refinancing Your Mortgage to Include Roof Replacement

If you have significant equity in your home and current mortgage interest rates are lower than your existing rate, a cash-out refinance could be an option. This involves taking out a new, larger mortgage that pays off your old mortgage and provides you with the difference in cash. The cash can then be used for your roof replacement.Cash Out Refinance for Home Improvements

A cash-out refinance can be attractive because mortgage interest rates are typically lower than personal loan or credit card rates, and the interest may be tax-deductible. However, it also means extending your mortgage term and potentially paying more interest over the life of the loan. There are also closing costs associated with refinancing, which can be substantial. This option is best suited for homeowners who plan to stay in their home for a long time and can benefit from a lower overall interest rate on their entire mortgage.Saving Up and Staged Payments for Your Roof Project

Sometimes, the simplest approach is the best. If your roof isn't in immediate danger of failing, you might consider saving up for the replacement. This allows you to avoid interest payments altogether. You could also discuss a staged payment plan with your contractor, where you pay in installments as different phases of the project are completed. This can help manage cash flow, but you'll still need to have the funds available.Benefits of Saving for Your Roof Replacement

No interest, no debt, and complete control over your project. If you have the luxury of time, saving up can be the most financially sound decision. Consider setting up a dedicated savings account and making regular contributions. Even if you can't save the entire amount, having a substantial portion saved will reduce your borrowing needs and overall costs.Comparing Financing Options for Your Roof Replacement

Choosing the right financing option depends on several factors: your credit score, the amount you need, how quickly you need the funds, and your comfort level with using your home as collateral. Here's a quick comparison:- Home Equity Loan/HELOC: Best for homeowners with significant equity, looking for lower interest rates and potentially tax-deductible interest. HELOC offers flexibility, HEL offers fixed payments.

- Personal Loan: Good for those without equity or who prefer not to use their home as collateral. Faster approval, but potentially higher interest rates.

- Contractor Financing: Convenient, sometimes offers promotional 0% APR, but compare terms carefully.

- Insurance Claim: Ideal if damage is due to a covered peril; only pay your deductible.

- Credit Cards: Only for small, emergency repairs or down payments, and only if you can pay off quickly.

- Cash-out Refinance: Good if you have equity, want lower interest rates, and plan to stay in your home long-term, but involves closing costs.

- Saving Up: The most financially prudent if time allows.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)